What Are Business Loans Typical Interest Rates?

If you are looking to get a small business loan in Springfield, IL to start or grow your business, you are probably wondering about the typical business loan interest rate. According to statistics, the average loan interest rate for business loans ranges from 2% to 7%, but there are cases when it is as high as 100% or even more.

All of this is because there are so many different types of business loans that are available for borrowers. So, the answer is not entirely clear. The best way to figure out the interest rate is by understanding the type of loan needed for your business and your unique credit situation.

What are the average business loan interest rates by loan type?

The interest rates differ based on the type of loan selected. When searching for a business loan, you might come across different types of lenders including national banks, credit unions, online banks, online lenders, and more.

For instance, the average business loan interest rate for traditional bank loans goes from 2% to 13%, while SBA loans charge you 3.75% to 10.25% on average. With online loans and lenders, you should expect to pay anywhere from 7% to 100% in interest rates, while merchant cash advances have 20% to 250% in interest.

You might also come across different interest rates based on different types of loans. For instance, secured loans (which require collateral) typically charge lower interest rates. This is because of the collateral that is available for repossession in case the borrower defaults.

Fixed and variable interest rates

When it comes to interest rates, you should also know that some types carry fixed ones, which means the rate remains the same for the entire loan period. However, other loan types carry variable rates, which means that the rate can change.

Therefore, loans with variable rates may be tied to the prime rate, or any other rates in the economy. That is why variable rates are often lower, but carry more risk for the borrower as both the rate and payment can change.

What is a competitive interest rate and how to get it?

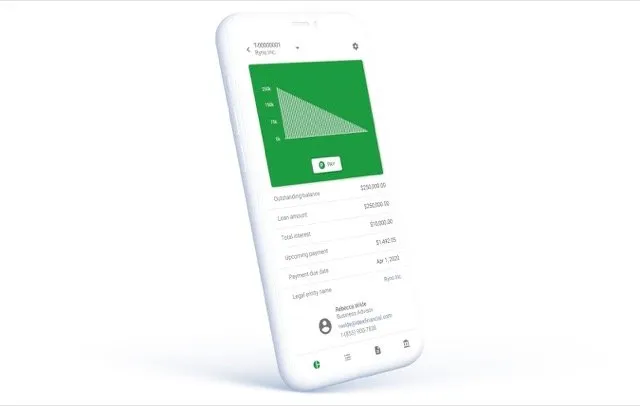

Since most of the interest rates are different, the range is broad, which is why it is difficult to know whether an interest rate offer that you get is competitive. The best way to get a competitive rate is by comparing all loan options before applying. This will ensure that you get the best deal.

The good thing is that there are plenty of commercial lenders, making it easy for you to get offers and view the current rates. It is also important to note that the interest rate you would receive will be based on your creditworthiness and the strength of your financials and credit history.

If you are looking for more information on typical loan interest rates, lines of credit, or want to apply for a loan and get quick approval, our team of loan advisors is here for you. Contact us today or fill out the application form to get started!